MCQ on Union Budget 2023-24

Multiple Choice Questions (MCQ Quiz) on Annual Financial Statement 2023-24 (Union Budget 2023-24) with answers and explanation. The MCQ based on traditional, contemporary and current affairs parts of Indian Economy, Indian Constitution, which is referred from the NCERT, News Papers and websites like PIB and others. It is useful for various competitive exams like UPSC, UPPSC, BPSC, IAS/PCS and others.

Union Budget 2023-24

The Union Minister for Finance & Corporate Affairs Smt.

Nirmala Sitharaman, while presenting the Union Budget 2023-24 in Parliament. It

emphasized that Indian economy is on the right track, and despite a time of

challenges, heading towards a bright future.

MCQ/Quiz on Annual Financial Statement 2023-24 (Union Budget 2023-24)

Q 1. According to Union Budget 2023-24, how many priorities

of Amrit Kaal?

a) Five Priorities

b) Six Priorities

c) Seven Priorities

d) Eight Priorities

Answer (c)

Explanation:

Seven priorities of the Union Budget 2023-24 ‘Saptarishi’

are inclusive development, they are as follows: 1) Inclusive Development 2)

Reaching the Last Mile 3) Infrastructure and Investment 4) Unleashing the

Potential 5) Green Growth 6) Youth Power 7) Financial Sector.

Q 2. In context of India’s Economic Growth estimated from

2023 to 2024, which among the following is Correct?

a) First among all major economies

b) Second among all major economies

c) Third among all major economies

d) Fourth among all major economies

Answer (a)

Q 3. The World has recognized the Indian Economy 2023-24 as a

‘bright star’ as the Economic Growth is estimated at:

a) 6 Percent

b) 7 Percent

c) 8 Percent

d) 9 Percent

Answer (b)

Explanation:

The World has

recognized the Indian Economy as a ‘bright star’ as the Economic Growth is

estimated at 7 per cent, which is the highest among all major economies, in

spite of the massive global slowdown caused by COVID-19 and Russia-Ukraine War.

Q 4. From 2014

(last nine years), Indian economy has increased in size from being 10th to:

a) 7th

b) 8th

c) 5th

d) 6th

Answer (c)

Explanation:

Indian Economy has achieved position from 10th to

5th largest economy in the world.

Q 5. According to Union Budget 2023-24 presented by Indian

Finance Minister, Atmanirbhar Clean Plant Program related to:

a)

Organic Horticulture

b) Urban Horticulture

c) Horticulture Crops

d) Viticulture

Answer (c)

Explanation:

Atmanirbhar Clean Plant Program with an outlay of ₹2200

crore to be launched to boost availability of disease-free, quality planting

material for high value horticultural crops.

Q 6. Under the Union Budget 2023, how many new nursing

colleges to be established:

a) 150

b) 157

c) 160

d) 167

Answer (b)

Q 7. Which scheme established 500 New ‘Waste to Wealth’

plants?

a)

Ujjwala

b) Gobargas

c) Biosafety

d) Gobardhan

Answer (d)

Explanation:

500 new ‘waste to wealth’ plants under GOBARdhan

(Galvanizing Organic Bio-Agro Resources Dhan) scheme.

Q 8. Consider the following statements regarding set-up of 10,000

Bio-Input Resource Centres:

1. One crore

farmers to adopt natural farming.

2. To creating a national-level distributed micro-fertilizer.

Which of the statements given above is/are correct?

a) 1 Only

b) 2 Only

c) 1 and 2

d) Neither 1 nor 2

Answer (c)

Explanation:

According to Union Budget 2023-24, one crore farmers to

adopt natural farming over the next three years. For this, 10,000 Bio-Input

Resource Centres to be set-up, creating a national-level distributed

micro-fertilizer and pesticide manufacturing network.

Q 9. With reference to Union Budget 2023-24, consider the

following statements:

1.

For an empowerd and inclusive economy.

2.

To be set up 30 Skill India International

Centres.

3.

PMKY 4.0 to skill lakhs of youth within the next

three years.

Which of the statements given above are correct?

a) 1 and 2 Only

b) 2 and 3 Only

c) 1 and 3 Only

d) 1, 2 and 3

Answer (d)

Q 10. What is vision for Amrit Kaal under Budget 2023-24?

a) Opportunities for Citizens with focus on youth

b) Growth in Job Creation

c) Strong and Stable Macro-economic Environment

d) All of the Above

Answer (d)

Q 11. According to annual financial statements (Budget

2023-24), Green Growth related to:

a) Green energy

b) Green farming

c) Green equipment

d) All of the Above

Answer (d)

Explanation:

Under Budget 2023-24, Green Growth related to many programmes

for green fuel, green energy, green farming, green mobility, green buildings,

and green equipment, and policies for efficient use of energy across various

economic sectors.

Q 12. India is the largest producer and second largest

exporter of ‘Shree Anna’, what is ‘Shree Anna’?

a) Millet

b) Rice

c) Pulses

d) Wheat

Answer (a)

Explanation:

India is the largest producer and second largest exporter of

‘Shree Anna’ or Millet in the world as it grows several types of 'Shree Anna'

such as jowar, ragi, bajra, kuttu, ramdana, kangni, kutki, kodo, cheena, and

sama.

Q 13. According to Union Budget 2023-24 presented by Indian

Finance Minister, which disease elimination mission launched?

a) Chickenpox

b) Malaria

c) TB

d) Sickle Cell Anaemia

Answer (d)

Explanation:

According to Union Budget 2023-24 presented by Indian

Finance Minister, Sickle Cell Anaemia elimination mission to be launched.

Q 14. Consider the following statements regarding Union

Budget 2023-24 for education:

1. Develop District Institutes of Education and Training.

2. To establish a National Digital Library for Children and

Adolescents.

Which of the statements given above is/are correct?

a) 1 Only

b) 2 Only

c) 1 and 2

d) Neither 1 nor 2

Answer (c)

Explanation:

District Institutes of Education and Training to be developed as vibrant

institutes of excellence for Teachers’ Training.

A National Digital Library for Children and Adolescents to

be set-up for facilitating availability of quality books across geographies,

languages, genres and levels, and device agnostic accessibility.

Q 15. Which one of the following is correct regarding Bharat

Shared Repository of Inscriptions (BSRI)?

a) Digitization of one lakh ancient inscriptions in the

first stage

b) Digitization of two lakh ancient inscriptions in the

first stage

c) Digitization of three lakh ancient inscriptions in the

first stage

d) Digitization of four lakh ancient inscriptions in the

first stage

Answer (a)

Explanation:

‘Bharat Shared Repository of Inscriptions’ to be set up in a

digital epigraphy museum, with digitization of one lakh ancient inscriptions in

the first stage.

Q 16. What is use of PM-PRANAM?

a) Balanced use of chemical fertilizers

b) Use Organic Fertilizers

c) Use of Clean Energy

d) Balanced use of thermal energy

Answer (a)

Explanation:

“PM Programme for Restoration, Awareness, Nourishment and

Amelioration of Mother Earth” (PM-PRANAM) to be launched to incentivize States

and Union Territories to promote alternative fertilizers and balanced use of

chemical fertilizers.

Q 17. Consider the following statements regarding Union

Budget 2023-24 for agriculture:

1. To encourage agri-startups through Agriculture

Accelerator Fund.

2. The global hub for Millets the Indian Institute of Millet Research in

Hyderabad.

Which of the statements given above is/are correct?

a) 1 Only

b) 2 Only

c) 1 and 2

d) Neither 1 nor 2

Answer (c)

Q 18. What is the new scheme that focuses on the fishermen?

a) PMFBY

b) Green Growth

c) Unified Package Insurance Scheme

d) New sub-scheme of PM Matsya Sampada Yojana

Answer (d)

Explanation:

A new sub-scheme of PM Matsya Sampada Yojana with targeted

investment of ₹6,000 crore to be launched to further enable activities of

fishermen, fish vendors, and micro & small enterprises, improve value chain

efficiencies, and expand the market.

Q 19. Which one of the following is correct regarding the

new MSME scheme announced in the Union Budget 2023?

a) To revamping of the credit guarantee scheme for MSMEs.

b) It will take effect from 1st April 2023 through infusion of

Rs 5,000 crore in the corpus.

c) The credit will be reduced by about 3 per cent.

d) The credit will be increased by about 1 per cent.

Answer (a)

Explanation:

The new MSME scheme revamping of the credit guarantee scheme

for MSMEs and announced happily that the revamped scheme will take effect from

1st April 2023 through infusion of Rs

9,000 crore in the corpus. This will enable additional collateral-free

guaranteed credit of Rs 2 lakh crore. Further, the cost of the credit will be

reduced by about 1 per cent.

Q 20. According to the Union Budget 2023-24, consider the

following statements:

1. PM VIKAS for centuries, traditional artisans and

craftspeople.

2. The theme of G20 is ‘Vasudhaiva Kutumbakam”.

Which of the statements given above is/are correct?

(a) 1 only

(b) 2 only

(c) Both 1 and 2

(d) Neither 1 nor 2

Answer (c)

Q 21. According to the Union Budget 2023-24, consider the

following statements regarding Pradhan Mantri PVTG Development Mission:

1. PVTGs stands for particularly vulnerable tribal groups.

2. To improve socio-economic conditions of PVTGs.

3. Centre will recruit 38,800 teachers and support staff for

the 740 Eklavya Model Residential Schools, serving 3.5 lakh tribal students.

Which of the statements given above are correct?

(a) 1 and 2only

(b) 2 and 3 only

(c) 1 and 3 only

(d) 1, 2 and 3

Answer (d)

Explanation:

To improve socio-economic conditions of the particularly

vulnerable tribal groups (PVTGs), Pradhan Mantri PVTG Development Mission will

be launched. This will saturate PVTG families and habitations with basic

facilities such as safe housing, clean drinking water and sanitation, improved

access to education, health and nutrition, road and telecom connectivity, and

sustainable livelihood opportunities. An amount of Rs 15,000 crore will be made

available to implement the Mission in the next three years under the

Development Action Plan for the Scheduled Tribes. Government announced that in

the next three years, centre will recruit 38,800 teachers and support staff for

the 740 Eklavya Model Residential Schools, serving 3.5 lakh tribal students.

Q 22. What is revised estimate of the fiscal deficit of GDP?

a) 5.4 percent

b) 5.8 percent

c) 6.4 percent

d) 6.8 percent

Answer (c)

Explanation:

The Revised Estimate of the fiscal deficit is 6.4 per cent

of GDP, adhering to the Budget Estimate.

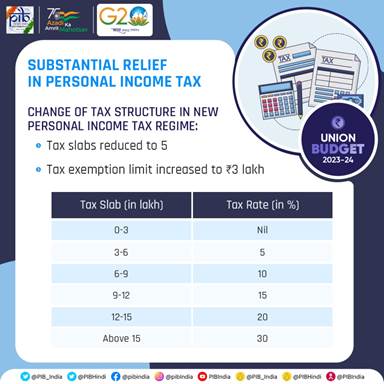

Q 23. What is the rate of tax for Income tax slab between

the income of Rs 6 Lakh to Rs 9 Lakh in Budget 2023-24?

a) 5 percent

b) 10 percent

c) 15 percent

d) 20 percent

Answer (b)

Explanation: (in Pic)

Q 24. According to the Union Budget 2023-24, consider the

following statements regarding indirect tax:

1. Excise duty exempted

on GST-paid compressed bio gas.

2. Import duty on silver dore, bars and articles reduced.

3. National Calamity Contingent Duty on specified cigarettes

has been revised upwards by about 16%.

Which of the statements given above are correct?

a) 1 and 2 only

b) 2 and 3 only

c) 1 and 3 only

d) 1, 2 and 3

Answer (c)

Q 25. The first paperless (digital budget) budget presented

in India:

a) 2020-21

b) 2021-22

c) 2022-23

d) 2023-24

Answer (b)

Q 26. Which is an INCORRECT regarding Budget?

a) It is an annual Financial Statement

b) Joint Session of the Parliament due to Dead lock

c) More power in Lok Sabha

d) Budget represent in parliament with prior recommendations

of the President

Answer (b)

Q 27. What is the duration of a financial year?

a)

February 1st to January 31st

b)

October 1st to September 30th

c)

April 1st to March 30th

d)

January 1st to December 30th

Answer (c)

Q 28. Which article of the Indian Constitution provides for Union

Budget?

a) Article 110

b) Article 111

c) Article 112

d) Article 113

Answer (c)

Q 29. Who was the first Finance minister of independent

India?

a)

B.R. Ambedkar

b)

Shanmukhan Chetty

c)

John Mathai

d)

Liaquat Ali Khan

Answer (c)

Q 30. With reference to Budget:

1. The word budget is mentioned in the Indian Constitution.

2. Annual Financial Statement is known as Budget.

Which of the statements given above is/are correct?

(a) 1 only

(b) 2 only

(c) Both 1 and 2

(d) Neither 1 nor 2

Answer (b)

a) Economic Empowerment of Women through SHGs

b) PM Vishwakarma Kaushal Samman (PM VIKAS)

c) Digital Industries Development

d) Tourism Promotion in Mission Mode

Answer (c)

Q 32. What is Mahila Samman Vikas Patra?

a) Political Reservations

b) Financial assistance to SHGs

c) Increase annual interest on savings of Rs 2 lakh for

women

d) Award to best women startups

Answer (c)

Explanation:

A special initiative has been taken for women's empowerment

with the announcement of Mahila Samman Vikas Patra. Under it, women will now

get 7.5% interest annually on savings of Rs 2 lakh.

Q 33. What is aim of National Digital Library?

a) To provide high-quality books to children only

b) To provide high-quality books to adolescents only

c) To provide high-quality books in only two languages Hindi

& English

d) To provide high-quality books to children and adolescents

Answer (d)

Explanation:

The National Digital Library will be established to provide

high-quality books to children and adolescents from various regions, languages,

subjects, and levels.

Q 34. What will be expenditure on education in the FY23?

a) 3 Percent

b) 2.3 Percent

c) 2.9 Percent

d) 3.1 Percent

Answer (c)

Explanation:

The expenditure on education: 2.9 percent of GDP of FY-2023.

Q 35. With reference to the aspirational block programme,

Consider the following statements:

1. It implemented in 112 blocks.

2. To improve government services in a wide range of areas.

3. It is covering 500 blocks.

Which of the statements given above are correct?

a) 1 and 2 only

b) 2 and 3 only

c) 1 and 3 only

d) 1, 2 and 3

Answer (b)

Explanation:

The central government has launched an aspirational block

programme covering 500 blocks to improve government services in a wide range of

areas, including health, nutrition, education, agriculture, water resources,

financial inclusion, skill development, and basic infrastructure.

Q 36. In the last 9 years despite economic constraints in

the global pandemic, the government has increased investment in infrastructure

by:

a)

100%

b)

200%

c)

300%

d)

400%

Answer (d)

Q 37. Which one of the following is

correct regarding urban sanitation?

a)

Cleaning of urban area will be done by machine

only

b)

Cleaning of septic tanks and sewers will be done

by machine only

c)

Both (a) and (b)

d)

None of the Above

Answer (b)

Explanation:

For urban sanitation, 100 percent cleaning of septic tanks

and sewers will be done by machine and scientific management of waste will be

taken care of.

Q 38. In the context of Mission Karmayogi, Consider the

following statements:

1. To set up a transparent and accountable governance

system.

2. It is for efficient human resource management.

Which of the statements given above is/are correct?

(a) 1 only

(b) 2 only

(c) Both 1 and 2

(d) Neither 1 nor 2

Answer (c)

Q 39. The National Green Hydrogen Mission will:

a) Assist the economy only

b) Assist to achieve target of net zero emission

c) Both (a) and (b)

d) None of the Above

Answer (c)

Q 40. According to Union Budget 2023-24, MISHTI is stand

for:

a) Mangrove Initiative for Shoreline Habitats and Tangible

Income

b) Mangrove Initiative for Shoreline Habitats and Technical

Innovation

c) Marine Initiative for Shoreline Habitats and Tangible

Income

d) Marine Initiative for Shoreline Habitats and Technical Innovation

Answer (a)

Explanation:

MISHTI: The government is determined to build on India's

success in the forestry sector. For this, an initiative named "Mangrove

Initiative for Shoreline Habitats and Tangible Income" (MISHTI) has been

taken. Under this initiative, mangrove plantations will be done in coastal

areas with the help of coordination between institutions like MGNREGA and

CAMPA.

Q 41. Where does highest money come from?

a) Goods & Services Tax

b) Borrowing and Other Liabilities

c) Income Tax

d) Corporation tax

Answer (b)

Q 42. Where is more money spent?

a) Interest Payments

b) States’ share of Taxes and Duties

c) Central Sector Schemes

d) Centrally Sponsored Schemes

Answer (a)

Q 43. With reference to fiscal management in budget 2023-24,

consider the following statements:

1. Interest-free loan to states for 50 years.

2. States are allowed a fiscal deficit of 4.5 percent of

GSDP.

Which of the statements given above is/are correct?

(a) 1 only

(b) 2 only

(c) Both 1 and 2

(d) Neither 1 nor 2

Answer (a)

Explanation:

States are allowed a fiscal deficit of 3.5 percent of GSDP.

Post a Comment

Post a Comment

Thanks...keep in touch 🤟