EPF vs. EPS: Key Differences, Tax Benefits, Eligibility & Calculation Explained

Introduction

If you are a salaried employee in India, retirement planning is not just a choice—it’s essential. Two significant pillars of such planning are the Employees’ Provident Fund (EPF) and the Employees’ Pension Scheme (EPS). Both are regulated under the EPF Act, 1952, and help provide financial stability after retirement. However, their structure, purpose, and benefits differ substantially. Let’s break down the differences, eligibility, and benefits so you can make the most informed decisions about your financial future.

What Is EPF (Employees’ Provident Fund)?

EPF is a retirement savings scheme where both the employee and the employer contribute a percentage of the employee’s basic salary plus dearness allowance each month. The primary goal is to build a significant corpus—plus interest—for employees to withdraw after retirement or certain qualifying situations like long-term unemployment.

- Employee contribution: 12% of basic salary + DA every month

- Employer contribution: Also 12%, but divided between EPF and EPS

The EPF account earns an attractive interest rate, regulated annually by the EPFO. For FY 2023–24, the rate is 8.25% p.a., and this interest is tax-exempt as long as specific conditions are met.

Who Is Eligible for EPF?

- Employees of any organization covered under EPFO (usually with 20+ staff)

- Compulsory for employees earning ₹15,000/month or more, and voluntary for others

- No minimum or maximum age to join, but withdrawals are generally allowed after 60 days of unemployment or retirement

Key Benefits of EPF

- Lump sum withdrawal post-retirement or under special circumstances (marriage, home loan, medical emergencies)

- Interest and maturity amount are mostly tax-exempt

- Secured and government-backed

- Portable via Universal Account Number (UAN)—remains the same even if you switch jobs

What Is EPS (Employees’ Pension Scheme)?

EPS is a pension scheme designed to offer employees a steady income after retirement. While you, as an employee, do not directly contribute—your employer allocates a portion of their EPF contribution towards EPS:

- Employer contribution to EPS: 8.33% of basic salary + DA (up to ₹1,250/month per employee)

EPS does not earn interest like EPF. Pension benefits begin at the age of 58 (regular pension) or as early as 50 (with reduced pension). A minimum of 10 years’ service is required to qualify for monthly pension benefits.

Who Is Eligible for EPS?

- Employees working in establishments covered by EPFO

- Must have completed 10 years of service for monthly pension eligibility

- Maximum eligible salary for EPS contribution is ₹15,000/month

- Pension payable to nominees in case of the employee’s death

Key Benefits of EPS

- Lifetime monthly pension for retired employees

- Provides pension benefits to widows, children, or nominees

- Pension calculation is formula-based:

Monthly pension=Average salary of last 12 months×Years of service70Monthly pension=70Average salary of last 12 months×Years of service

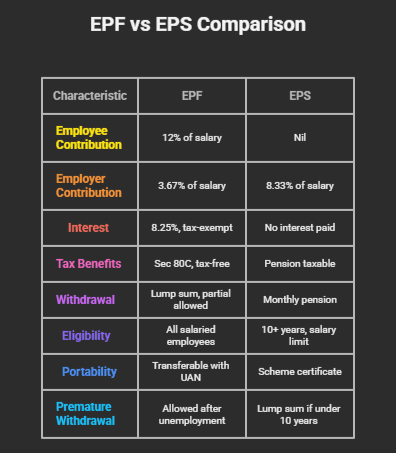

EPF vs EPS: Quick Comparison

| Feature | EPF | EPS |

| Employee Contribution | 12% of basic salary + DA | Nil |

| Employer Contribution | 3.67% of basic salary + DA | 8.33% of basic salary + DA (up to ₹1,250) |

| Interest | 8.25% (for FY 2023–24), tax-exempt | No interest paid |

| Tax Benefits | Sec 80C deduction & tax-free interest/maturity | Pension taxable as per income slab |

| Withdrawal | Lump sum after retirement/unemployment, partials | Monthly pension post 58 years |

| Eligibility | All salaried employees under EPFO regime | 10+ years of service, salary up to ₹15,000 |

| Portability | Transferable with UAN after job change | Scheme certificate for service under 10 years |

| Premature withdrawal | Allowed after 60 days of unemployment or for emergencies | Lump sum if under 10 years of service |

Taxation of EPF and EPS

- EPF: Contributions qualify for Section 80C deductions (up to ₹1.5 lakh/year). Interest and maturity proceeds are tax-free unless withdrawn within five years of continuous service (then TDS @10% applies).

- EPS: Pensions received under EPS are fully taxable according to the recipient’s income slab; no additional tax-free limit.

How Contributions Are Split (with Example)

Suppose your basic salary plus DA is ₹15,000/month:

- Your Contribution: ₹15,000 × 12% = ₹1,800 (to EPF each month)

- Employer’s Total Contribution: ₹15,000 × 12% = ₹1,800

- Of which, ₹550.50 (3.67%) goes to your EPF,

- and ₹1,249.50 (8.33%) goes to EPS

Thus, your EPF grows with both your own and part of your employer’s contribution, plus interest. EPS accumulates only out of the employer’s share and does not earn interest.

Withdrawal Rules

EPF

- Full withdrawal allowed at retirement or after 2 months of unemployment

- Partial withdrawal for housing, education, marriage, or serious illness

- Early withdrawals (<5 years of service) may attract tax

EPS

- Monthly pension starts at age 58 after 10 years of service

- Early pension after 50 years (reduced rate)

- Lump sum withdrawal for those who leave service before 10 years

Portability and Scheme Certificate

- UAN (Universal Account Number): Ensures all EPF accounts from multiple jobs are linked

- Scheme Certificate: Issued if you exit service with <10 years, allowing benefits transfer on re-employment; necessary for family members to claim pension if the member dies before pensionable service

Conclusion

Both EPF and EPS aim to secure your retirement but offer benefits differently—EPF builds a lump sum through regular savings, while EPS provides monthly pension support. Understand your eligibility, contribution, and withdrawal rules carefully to make the most of both schemes.

Tip: Consider supplementing these schemes with fixed deposits, NPS, or other investments for a comprehensive retirement plan.

Frequently Asked Questions (FAQs)

Q1. Can an employee withdraw both EPF and EPS after leaving the job?

Yes. EPF can be withdrawn fully after specified unemployment/retirement conditions, while EPS can be withdrawn as pension (after 10 years of service) or as a lump sum if conditions are not met.

Q2. Is the interest earned on EPF taxable?

Interest on EPF is tax-exempt if all conditions are met—withdrawals within five years may attract TDS.

Q3. What happens to EPS if you switch jobs?

A scheme certificate enables you to transfer and accumulate benefits; your UAN keeps EPF balances linked for continued savings.

Source: Economic Times, Bank Bazaar